C4.12 Tax Refund on Parcels¶

Tax Refund for UK Parcels

Recently, customs inspections have been strict, and several parcels have been taxed. But don’t worry—UK Customs, being user-friendly, allows tax refund applications. For couriers sent from China to the UK, as long as they are non-prohibited items, non-commercial in purpose, and private goods with low value and small quantity, you can apply for a tax refund.

For regular parcels, the probability of being randomly inspected is 10%, which is very low. However, if a parcel is inspected by customs, the delivery time will be delayed. Additionally, the customs letter (notifying you to pay tax first) will take about a week to arrive.

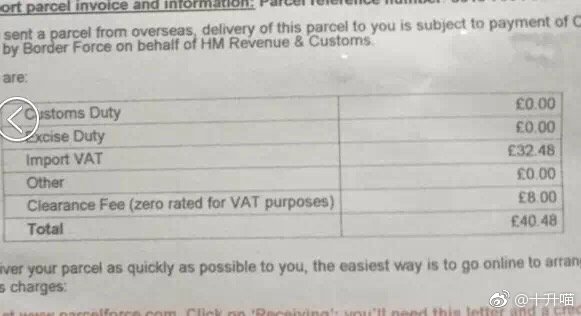

A few days ago, a lovely girl’s parcel was inspected. She later received a customs tax notice (as shown in the picture below), which required her to pay £40 in tax.

Fortunately, UK Customs is still reasonable. As long as you can prove that your items are for personal use (not commercial purposes) and of low value, you will be eligible for a tax refund. However, you must first pay the tax through the website provided on the notice to receive your parcel.

Once you have the parcel in hand, you can start applying for the tax refund.

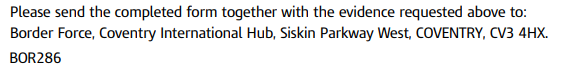

Note: The BOR286 form below is currently used for Parcel Force and Royal Mail. Additionally, full-time students have a higher probability of successfully claiming the tax refund compared to others.

Step 1:

Visit the following website:

Click to access the UK government’s tax refund form, then download the BOR286 form shown in the picture below.

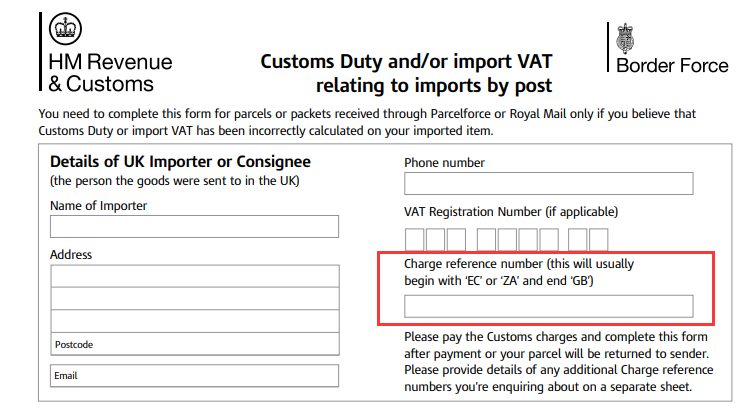

Step 2: Fill in the form

In the column labeled "Charge reference number (this will usually begin with ‘EC’ or ‘ZA’ and end ‘GB’)", enter the tracking reference number provided in the letter sent to you by Customs.

Figure 1: Enter your tracking reference number in the blank space.

Generally, your tracking reference number can be found at the top left corner of the customs letter you received.

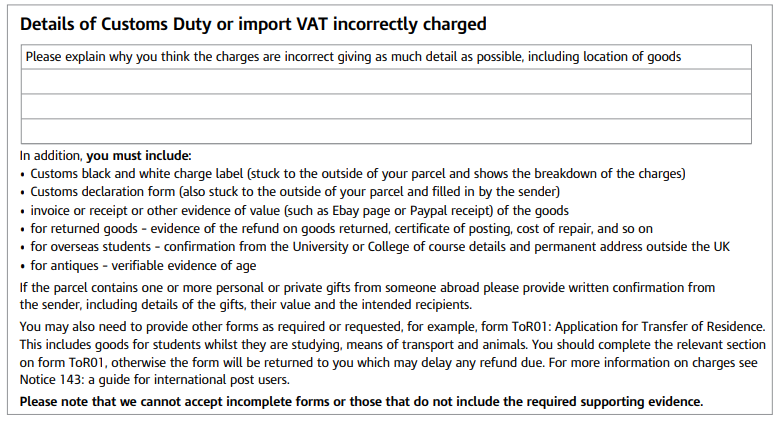

2. In the column "Details of Customs Duty or import VAT incorrectly charged", explain why you believe this fee should not be imposed. When writing, you must express yourself in a very aggrieved tone. State that you are a full-time student with no income, the items being sent have low value, all are personal goods for your own use, and they were sent by your parents out of care for you, among other points.

Figure 1: Enter your reasons in the blank horizontal lines.

Step 3: Print the student confirmation letter, courier waybill, tax payment receipt, and other relevant documents separately.

Step 4: Put all these documents together in an envelope and post them to the address specified on the BOR286 form.

Step 5: After sending the documents, you will receive a reply in approximately 3 to 5 weeks. If the tax refund application is successful, a clearance fee of around a dozen pounds will be deducted first, and then you just need to wait for the tax amount to be directly refunded to the UK bank account you provided.

Generally, as long as your items are for personal use (not commercial purposes), of low value, and in small quantities, the tax you paid will be refunded. However, a certain clearance fee may be charged—after all, Customs has put in a lot of work, so it’s good to be mutually understanding.

Regarding the C3 form, it seems to have been changed recently and is no longer required. If you are applying for a tax refund through another courier company, you only need to contact that company to ask them to provide the relevant documents. For example, DHL requires forms E2 and C285.