A4.12 Buying Property in the UK¶

How to buy property in the UK? Can you buy UK property while living abroad? Can you buy UK property on a tourist visa?

As of January 7th, 2021, UK time, in the future, all leaseholders in the UK will be able to extend their lease by 990 years with zero ground rent after purchasing the property. This applies to both flats and houses.

Furthermore, if a leaseholder wishes to become the freeholder, they will only need to use an online government calculator to work out the premium, which will be subject to a cap, pay the amount and then can become the freeholder.

Thirdly, it will abolish marriage value and set the calculation rates to ensure this is fairer, cheaper, and more transparent.

This 'marriage value' charge primarily refers to the situation where a leaseholder wants to extend the lease, and the freeholder demands that the leaseholder pay a share of the property's increased value during the extension period as a condition for agreeing to the lease extension.

Additionally, the government will take further steps to protect the elderly. The government had previously committed to restricting ground rents on new leases to zero to make leasehold fairer. This will also apply to retirement leasehold properties, so buyers of these homes have the same rights as other homeowners and are protected from uncertain and escalating charges.

Leaseholders will also be able to voluntarily agree to restrict development on their property to avoid paying 'development value'.

Secondly, the government is currently establishing a Commonhold Council, comprising leasehold groups, the industry, and the government, to prepare homeowners and the market for the widespread use of Commonhold.

This Commonhold system means that homeowners also own a share of the freehold of the building and its land, so they don't pay ground rent, but must pay other property-related service charges, etc. It allows owners to own their property on a perpetual freehold basis, giving them greater control and ownership over their homes. The building blocks are jointly owned and managed, meaning when someone buys a flat or a house, it is truly theirs, and any decisions about its future are also theirs.

Legislation for the above will be introduced in an upcoming Parliamentary session, indicating that the UK property market is set to change.

Here is a separate breakdown:

Leasehold refers to the right to use the property for a fixed period.

Freeholder refers to the person or entity that owns the land and the building outright.

Ground Rent is an annual fee paid by the leaseholder to the freeholder. If this payment is not made, the freeholder has the right to take action, which could ultimately lead to forfeiture of the lease.

Head Lease / Lease Term: As Leasehold is only the right to use the property, it has a time limit. This duration is the lease term.

For example: A buys a Leasehold property (L), pays annual Ground Rent (G) to the Freeholder (F), and one year defaults on payment, leading F to take action which could result in the loss of the lease.

UK Government Official Link:

https://www.gov.uk/government/news/government-reforms-make-it-easier-and-cheaper-for-leaseholders-to-buy-their-homes

Reminder: This article is actually quite detailed, but some students have still faced fines, perhaps because they didn't read it carefully or missed certain points. Funds used to buy property in the UK require proof of a legitimate source. If the money is a gift from a relative overseas, a legally notarised gift deed is also required and must be declared; otherwise, you could face heavy fines or have your funds frozen. If you secretly buy a property outright with cash, it could be investigated at any time, even years later, potentially resulting not only in fines but also in the property being seized.

Reminder: Due to legal regulations, funds remitted from China cannot be used for buying property in the UK. One of the requirements for the proof of funds for a UK property purchase is the seasoning of the funds, and the UK generally does not accept funds originating from China for property purchases, though this can depend on the circumstances.

Firstly, it is possible to buy property in the UK while holding a UK tourist visa. TenLitCat reminds everyone that if you want to buy a property in the UK, you do not necessarily need to be physically present in the country; you can purchase a UK property from anywhere in the world. In other words, anyone, from anywhere, can buy property in the UK, subject to certain conditions, such as providing proof of legitimate funds. Even if you have never been to the UK and do not hold any UK visa, you can still buy UK property remotely without restrictions.

If you are studying in the UK for an undergraduate degree, PhD, or a combined bachelor's-master's-doctorate programme, and plan to stay in one place for a relatively long time, TenLitCat suggests that if you have sufficient means, buying a property is more cost-effective than renting. After buying, you can also rent it out to fellow students. When you plan to return to your home country, you can sell it. If the property price has increased in the meantime, you might even make a small profit.

Here is the situation of a friend of TenLitCat: he went to the UK for his master's degree and continued to a PhD. He bought a property in the UK after finishing his master's and is now a professor at a UK university. His reflection at the time was that rental prices were hugely inflated by speculation, creating a significant bubble that could burst at any time. He found that the premium paid on this unprofitable rent over several years amounted to more than the cost of simply buying a property. Besides living in it himself, he could also rent it out. So, he bought three properties: one to live in and two to rent out to students from his university at particularly low rents.

Around 2019, the family of an aunt of TenLitCat's bought a small apartment outright in London, roughly 50 square metres with a bathroom, kitchen, and living room, because her son was studying there. After he graduated, they rented it out to other students, achieving a very considerable rental income of several tens of thousands of RMB per month.

So, how do you buy property in the UK?

The process is essentially the same as for a UK citizen buying property in the UK, but it differs from the process in China. To buy property in the UK, you generally only need to provide a passport or ID and proof of address.

Step 1: Pre-purchase Planning and Research

Before buying, you need to do some research, including deciding which area you want to buy in, what type of property, the price range, how you will pay, which estate agent to use, whether to find your own solicitor or use one recommended by the agent, whether to buy a second-hand property or a new build, and whether to view properties in person or use a buying agent.

Specifically:

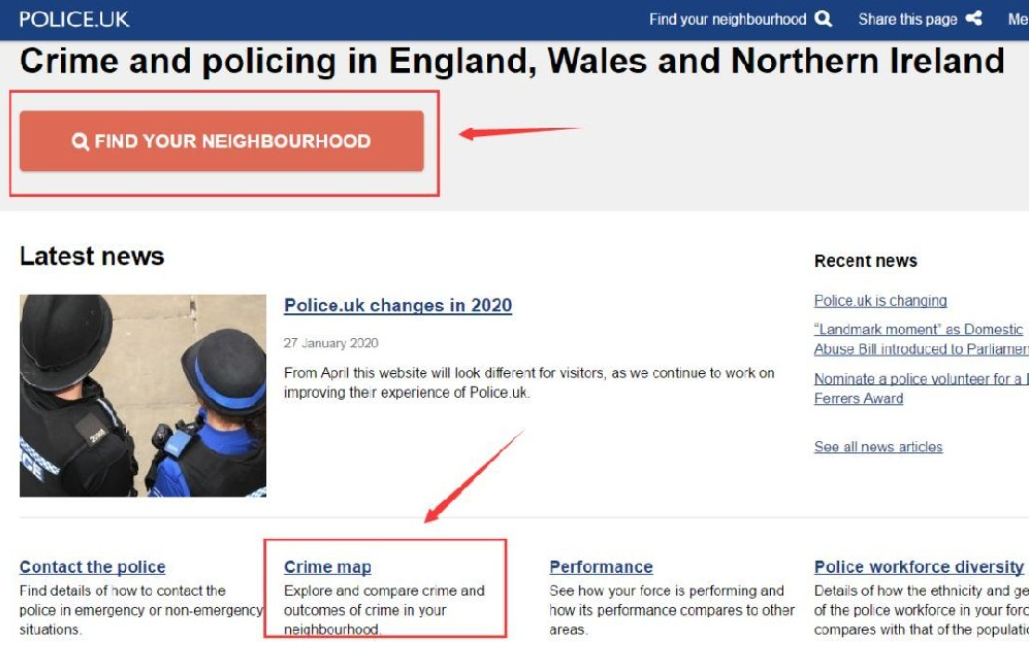

Check the geographical environment: Research the location and surrounding area of where you want to buy. For example, if buying in London, decide exactly which part of London. Also, look into the various local amenities, safety environment, Council Tax band, etc. Amenities include education, healthcare, entertainment facilities, public services, green spaces, the neighbourhood profile, transport links, job opportunities, the utility and telecom providers in the area, convenience for daily life, and so on. Also, check the crime rate in the area around the property by visiting the official UK police website. Do this before buying to choose an area with relatively better public security.

Website to check crime statistics for England, Wales, and Northern Ireland: https://www.police.uk/

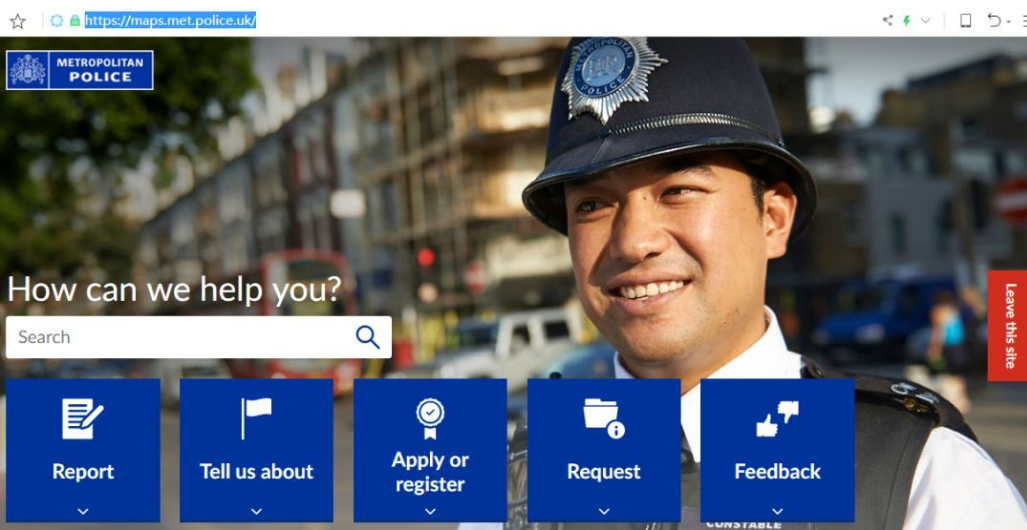

Official website for viewing crime statistics in various London areas: https://maps.met.police.uk/

Choose the Type of Property

Select the type of property you wish to purchase, including its size, number of rooms, age, orientation, garage availability, price, and service charges (where applicable). In the UK, properties come in various forms—flats, detached houses, and terraced houses. Flats range from one-bedroom-one-reception to two-bedroom-one-reception layouts. Some properties face the sea, others face roads; some have both front and rear gardens, while others may only have a rear garden. The choices are quite diverse.

Decide whether to buy a resale property or a new build. If considering a resale, pay attention to its condition and whether you plan to renovate later. I generally recommend working with a reputable, established estate agent (it’s wise to compare several and check their online ratings). If buying a new build, you can often purchase directly from the developer, sometimes at a discount, and choose between a finished property or one you customise.

I must remind you that properties in the UK are categorised as either Leasehold or Freehold.

Leasehold means you own the right to use the property for a fixed term, known as the lease (e.g., typically ranging from 125 to 999 years). This often applies to many flats and some houses. If you buy a Leasehold, it’s crucial to confirm the remaining lease length.

Freehold means you own the property and the land it stands on outright, with no time limit.

Another key point to note is Ground Rent. If you purchase a Leasehold, you are generally required to pay an annual Ground Rent to the Freeholder. Failure to pay this can give the Freeholder the right to take action, potentially leading to the forfeiture of the lease.

Therefore, it is essential to scrutinise the contract terms carefully and discuss them thoroughly with your solicitor. Some landlords or developers may include clauses that double or significantly increase the Ground Rent every few years. This could result in Leaseholders facing substantial annual costs—potentially reaching £10,000 to £20,000 in the future—with the constant risk of hikes.

A common question I’m asked is: if someone mistakenly buys a Leasehold, can they later purchase the Freehold? In principle, yes, but it is often very expensive. The developer or Freeholder may demand a high price—possibly tens of thousands of pounds—depending on their terms.

Regarding Ground Rent, in 2019, the UK Housing Secretary James Brokenshire announced proposed reforms, including:

Reducing ground rents to zero for new leases.

Selling all new houses as Freehold by default, unless exceptional circumstances apply.

Amending the Help to Buy scheme to prevent taxpayer money from supporting the sale of unjust Leasehold properties.

In other words, the UK will introduce policies to abolish Leasehold for houses in the future.

For example, if A buys a Leasehold property in the UK, they can live in it themselves or rent it out to others, etc. However, as the property is Leasehold, it has a time limit – the lease term – allowing use of the property for a set period, such as 200 or 999 years. Essentially, A only has the right to use the property for this specified term. The property itself and the land it stands on belong to the Freeholder. Therefore, A must pay an annual Ground Rent to the Freeholder, which could range from a few hundred to tens of thousands of pounds. Once the policy is implemented, this Ground Rent would no longer be payable, and new houses would be Freehold.

However, this policy has not yet been introduced. Once it is, it will be excellent, protecting homebuyers' interests as everyone will have permanent ownership.

I must also remind you of another important point: if you buy a Leasehold property and wish to make alterations, you must obtain permission from the Freeholder and likely pay a fee. This includes renovations, adding a balcony, changing the property's structure, etc. Even if you successfully apply for planning permission from the council, you still need the Freeholder's consent and will probably have to pay a fee, which could be hundreds or thousands of pounds.

If you are viewing properties remotely from within the UK or from abroad and want to get a preliminary understanding of UK property types, sizes, locations, etc., you can look online.

UK property websites include:

Rightmove.co.uk

Zoopla.co.uk

Primelocation.com

Of these three property websites, Rightmove is the UK's largest property portal, where many estate agents list properties. Essentially, most properties on there are listed via agents. Zoopla is the second largest property website in the UK. The third, Prime Location, belongs to the Zoopla group. Prime Location primarily focuses on properties in good locations that are more upmarket, meaning properties with excellent overall conditions, which also tend to be very expensive.

3) Purchase Funds and Proof

Have sufficient funds ready and provide proof of a legitimate source of funds. Once you've determined the previous steps regarding the property, you'll have a clearer idea of your budget and the type of property you want. At this stage, decide in advance whether you plan to get a mortgage, pay in cash, or use another payment method like a card. If getting a mortgage, you need to prepare a sufficient deposit, assess your borrowing capacity, and clarify the details with your bank beforehand. If paying by card, check the spending limits – for example, UnionPay cards can also be used for property purchases. Generally, paying in cash is advantageous in any country and can sometimes secure you an extra discount.

Beyond the property price and deposit, also consider fees such as estate agent fees, holding deposits, Stamp Duty Land Tax, Capital Gains Tax, legal fees, and various other costs. Of course, after purchasing, potential expenses like decoration and moving also need to be budgeted for.

Furthermore, you must provide proof of the source of your funds for the purchase to demonstrate their legality. It is best to prepare this proof before transferring the money to a UK account.

I remind you:

If the money for the purchase is from your parents, they must provide proof of the legitimate source of their funds, followed by a notarised certificate confirming the gift to you. If the funds are from an inheritance, you will need the will or related supporting documents, also best notarised.

If you sold a property you owned in your home country or another nation, or if a relative/friend sold their property or took out a mortgage and gave you the proceeds to buy a UK property, this money generally doesn't require a separate proof of legitimate source. However, you will need documents like the property ownership proof, sales contract, bank statements, and other paperwork to demonstrate the money is legitimate. Getting these notarised is highly recommended.

If your funds come from stocks, funds, or other investments, you will need to provide relevant transaction records and supporting documents during verification, including but not limited to bank statements, signed contracts, or certificates from financial institutions.

If the money consists of cash savings painstakingly accumulated over decades by an older generation with limited formal proof, it might be acceptable via a detailed statement of source, witnessed by a solicitor and notarised. However, this document must be extremely thorough, specify the exact source of the funds, and require substantial evidence gathering.

If the money is borrowed from someone else, it is acceptable provided the lender can show proof of the legitimate source of their funds, and you provide a notarised certificate confirming the loan to you.

Proof of legitimate source of funds is crucial and must be prepared in advance. Without it, you cannot purchase the property, even with a full cash payment. This is a mandatory requirement. You must provide proof of origin regardless of how long the funds have been in a UK bank account.

In some cases, if your family directly transfers a sum of money (for the property purchase, including deposit, regardless of amount) to your UK account without this proof, your funds could be frozen by the UK bank or even confiscated by the authorities. If the money is later investigated and found to be illegal, you could not only lose it but also face prosecution.

Note: 'Illegal money' here doesn't solely refer to criminally obtained funds. Even money earned from legitimate business or employment, if the required taxes weren't paid, is considered illicit, as is money earned working illegally in the UK.

If you proceed to buy a property in full with cash without providing the required source of funds proof, the property you purchased in the UK can be seized.

If you have signed the contract but lack this proof, you are in breach of contract, liable to compensate the seller, and the property transaction will be halted. For highly desirable properties, another buyer might purchase it instead.

Therefore, I remind you again: you must prepare this proof of funds well in advance – it is mandatory. Note: Notarised documents should include an English translation alongside the Chinese. I have had many documents notarised, all in duplicate with both Chinese and English. Notary and translation fees can be expensive, but I recommend using the translation service provided by the notary office rather than sourcing your own translator or translating yourself.

Step 2: Property Viewing and Transaction Process

After completing the steps above, you can proceed.

1) Determine the Purchasing Channel

Decide whether to buy through an estate agent, directly from a developer, or via a buying agent. If you are in the UK and looking for a second-hand property, using an estate agent is generally advisable as they offer a comprehensive service, including handling procedures and recommending solicitors. Any issues are communicated directly through them.

Buying directly from a private landlord is also possible – you would find your own solicitor, provide the proof of funds, etc., and proceed with the transaction. Buying from a developer usually means an all-inclusive service covering mortgages and legal work, which is very convenient, time-saving, and effort-saving. If you are based abroad, you can appoint a representative (like a solicitor) to act on your behalf, typically by providing them with notarised copies of your ID card, passport, and proof of address.

I remind you that you must use a solicitor for a property purchase in the UK. They handle the legal documentation and assist if problems arise. It's wise to frequently seek their advice, consult friends who have bought property, and even ask potential neighbours about the area.

2) Schedule Viewings

Schedule appointments to view properties in person. Besides viewing yourself, you can ask the agent, developer, or your representative to assist with online video viewings. Check the surrounding environment mentioned before – distance to schools, supermarkets, property structure, etc. Some older properties might be unstable, require reinforcement, need rebuilding, or have hidden defects. Understand this clearly before buying, making viewings essential.

I remind you: In the UK, there's a general cultural norm to always book an appointment. Without one, you often can't get things done. For example, without an appointment, you likely cannot view a property. Also, similar to buying property domestically, you can usually pull out of the purchase before making any payment or depositing funds. However, once money is paid, you will undoubtedly incur some financial loss. You can, however, look around the exterior of a property yourself first before scheduling a viewing with the agent/developer, as your own impression might differ from the agent-led viewing.

3) Agree on the Price

Once you've selected a property, begin negotiating the price. Properties in the UK, including new builds from developers, are often open to negotiation or offers. For instance, a motivated seller might agree to a lower price. Or, if you tell a developer you can pay in full with cash, they will likely be very welcoming and may offer a discount.

I remind you: If buying through an agent, be aware that the asking price is often inflated, so negotiation is key. Aim for a price you find reasonable, which involves negotiation skills. This doesn't mean slashing the price in half immediately, but rather researching prices in the surrounding area beforehand, estimating a minimum market price you're comfortable with, while also satisfying the seller. Of course, for properties in excellent condition with high demand, negotiation is often impossible, and it becomes a case of the highest bidder winning – typical for sought-after school catchment areas or affluent neighbourhoods.

4) Property Survey

A survey is recommended for second-hand properties. It covers aspects like property considerations, repair advice, structural condition, and materials. Generally, when buying through an agent, they should provide a property valuation report, but note, this report is not a detailed, comprehensive survey. Survey costs can range from a few hundred to over a thousand pounds. The purpose is threefold: understand the property's specific condition, identify areas needing repair post-purchase, and provide a reference for the property's selling price.

I remind you, this survey is optional and entirely up to you, as the cost can be significant. Furthermore, it should only be done when you are 100% certain you want to buy the property, otherwise, it's somewhat wasteful. Common survey types include: Building Survey (more expensive, but comprehensive), Homebuyer Report (mid-range price, moderate detail), Condition Report (cheaper, less detail).

5) Legal Conveyancing and Insurance

The solicitors for both parties initiate the legal process, exchange contracts, and arrange for the deposit and Stamp Duty Land Tax (SDLT) payment. If buying through an agent/developer, they will usually recommend a solicitor, but you can find your own. Using a solicitor is mandatory for UK property transactions. The purchase becomes legally binding only upon the exchange of contracts. After exchange, based on the contract's completion date, you need to pay the deposit/balance and SDLT. During this period, your solicitor handles most paperwork, informs you of注意事项, etc. You just need to sign, but you must also read everything carefully yourself and verify all documents are present.

Ask your solicitor questions promptly. Pay special attention to whether the property has Buildings Insurance. Generally, new builds come with it, but not always, and second-hand properties might not. If you are applying for a mortgage, Buildings Insurance is mandatory. Secondly, Contents Insurance is also essential, primarily covering your belongings inside the property. For other types of insurance related to homeownership, ask your solicitor for advice on what to purchase.

I remind you, until contracts are exchanged, either party can usually withdraw without significant penalty (aside from possibly abortive costs like survey/solicitor fees), and no deposit is paid. However, once contracts are exchanged and the deposit is paid, any party breaching the contract faces compensation claims – e.g., the buyer forfeits their deposit. Secondly, Stamp Duty Land Tax (SDLT) is mandatory and paid to the UK government, calculated based on the property's value.

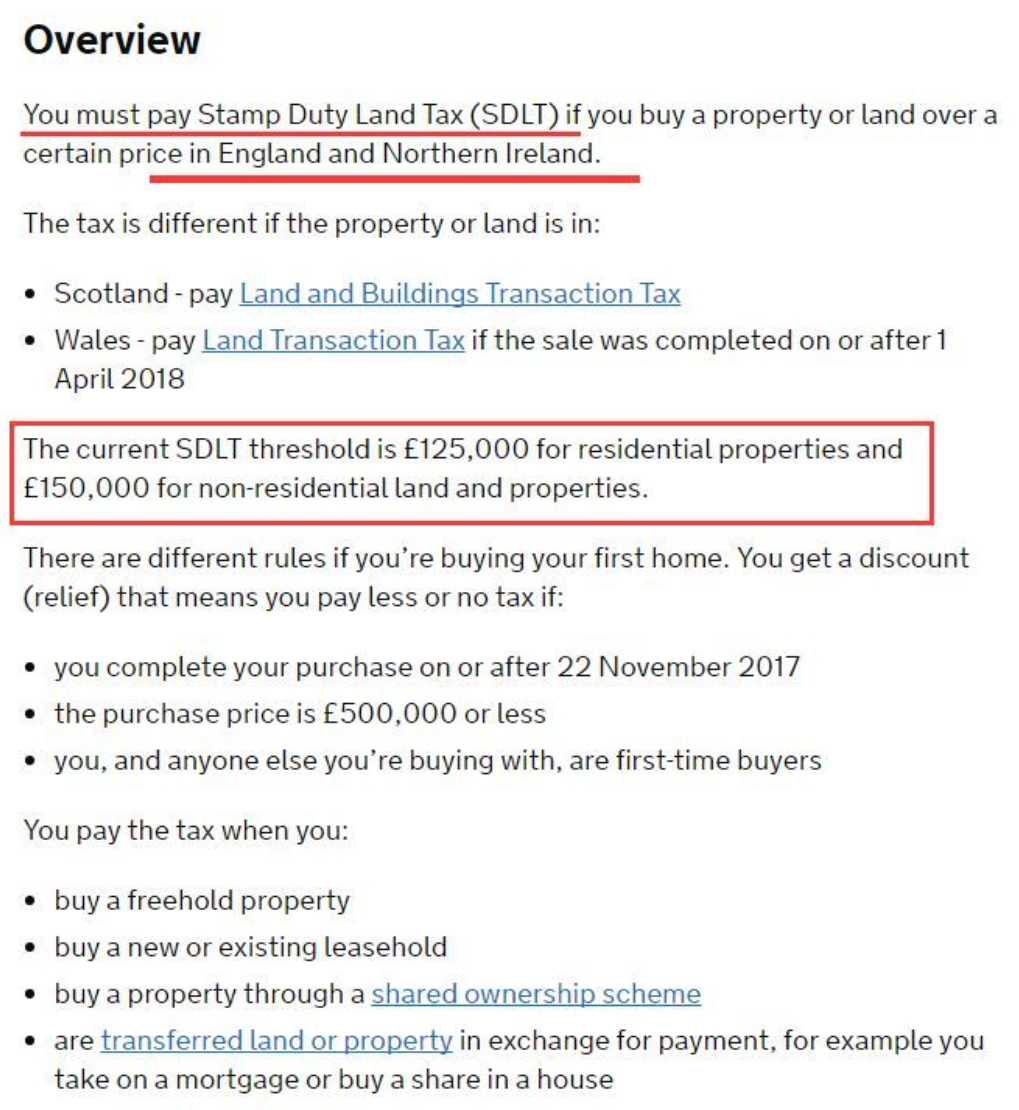

As per the figure below, the SDLT threshold is typically £125,000 for residential property and £150,000 for non-residential property and land, but first-time buyer relief is available.

reminds you: If you do not submit the return and make the payment within 14 days of completing the purchase, you may be charged penalties and interest. However, your conveyancing solicitor will typically assist you with this.

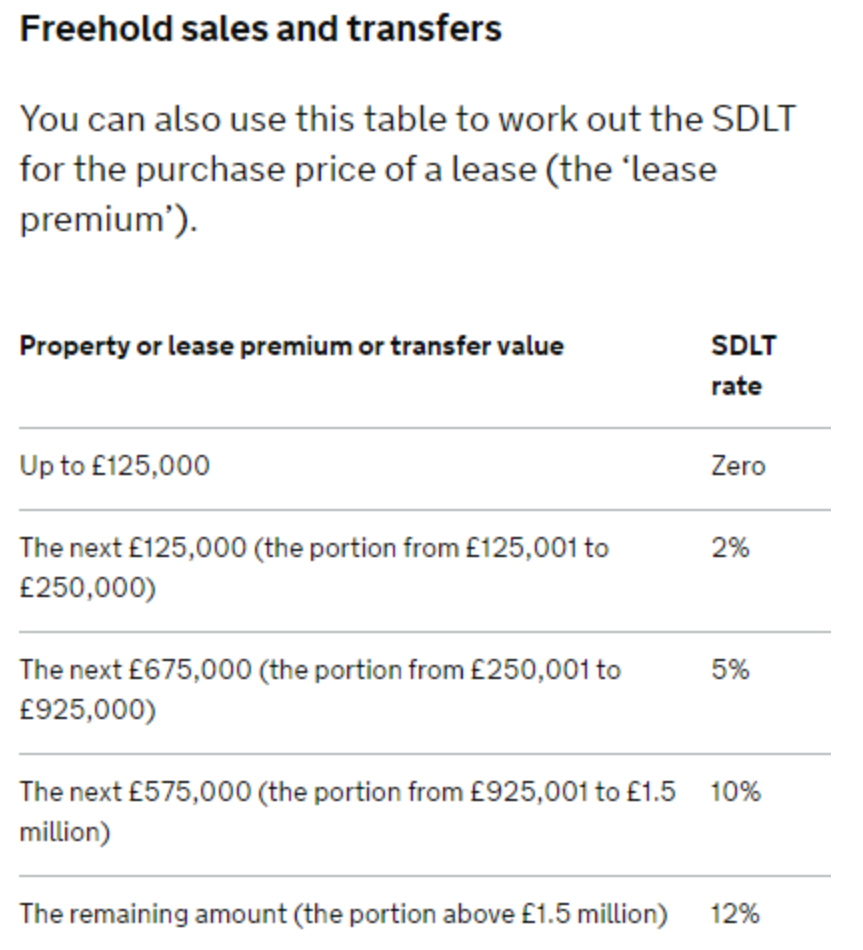

Please see the reference table for Stamp Duty rates below:

For example, if you buy a property for £275,000, the SDLT you would pay is calculated as follows:

0% on the first £125,000 = £0

2% on the next £125,000 = £2,500

5% on the final £25,000 = £1,250

Total SDLT due = £3,750

Link for more information on Stamp Duty:

https://www.gov.uk/stamp-duty-land-tax

6) Completion and Key Collection

Once everything is finalised, including the payment of all fees, your solicitor will confirm the procedure and timing for key collection and moving in. After you receive the keys, you can move in according to the agreed date, completing the purchase process. Your solicitor will then handle the final tasks, such as paying the stamp duty and registering the title. If any issues or disputes arise later, you can seek assistance from your solicitor.

I must remind you:

If you rent out a property you own in the UK, the rental income is subject to tax; this is mandatory. If you sell a property in the UK, you may be liable for Capital Gains Tax on the profit (the amount it has increased in value). For instance, if you bought a property for £100 and sold it for £150, you could owe tax on the £50 gain.

It is possible to buy a property jointly with others in the UK. However, the arrangements must be clearly defined. It is highly advisable to seek extensive advice from your conveyancing solicitor – ideally, prepare a list of questions and consult them on each point.

From March 2020 onwards, overseas buyers purchasing residential property in England and Northern Ireland may be subject to a 2% Stamp Duty Surcharge on top of the standard rates. The specific policy details were to be confirmed after the Spring Budget on March 11th (this reminder was originally dated February 25th, 2020). The UK government had already published some initial rules regarding this surcharge. An 'overseas individual buyer' is typically defined as someone who has spent fewer than 183 days in the UK in the 12 months preceding the purchase. However, if an overseas buyer subsequently resides in the UK for 183 days or more within a 12-month period after the purchase, they can apply for a refund of this surcharge.

To find out more about the Stamp Duty Land Tax surcharge for non-UK residents, you can visit the official government consultation page below. It contains very clear PDF documents which you are welcome to view and download, free of charge:

https://www.gov.uk/government/consultations/stamp-duty-land-tax-non-uk-resident-surcharge-consultation

There are no restrictions on the number of properties one can buy in the UK, applicable to anyone.

You cannot obtain immigration rights in the UK by purchasing property.

I must remind you that a visa is not required to buy property. Generally, buying a property outright with cash does not require legal residency status in the UK; this is typically only necessary if you are seeking a mortgage from a UK lender.